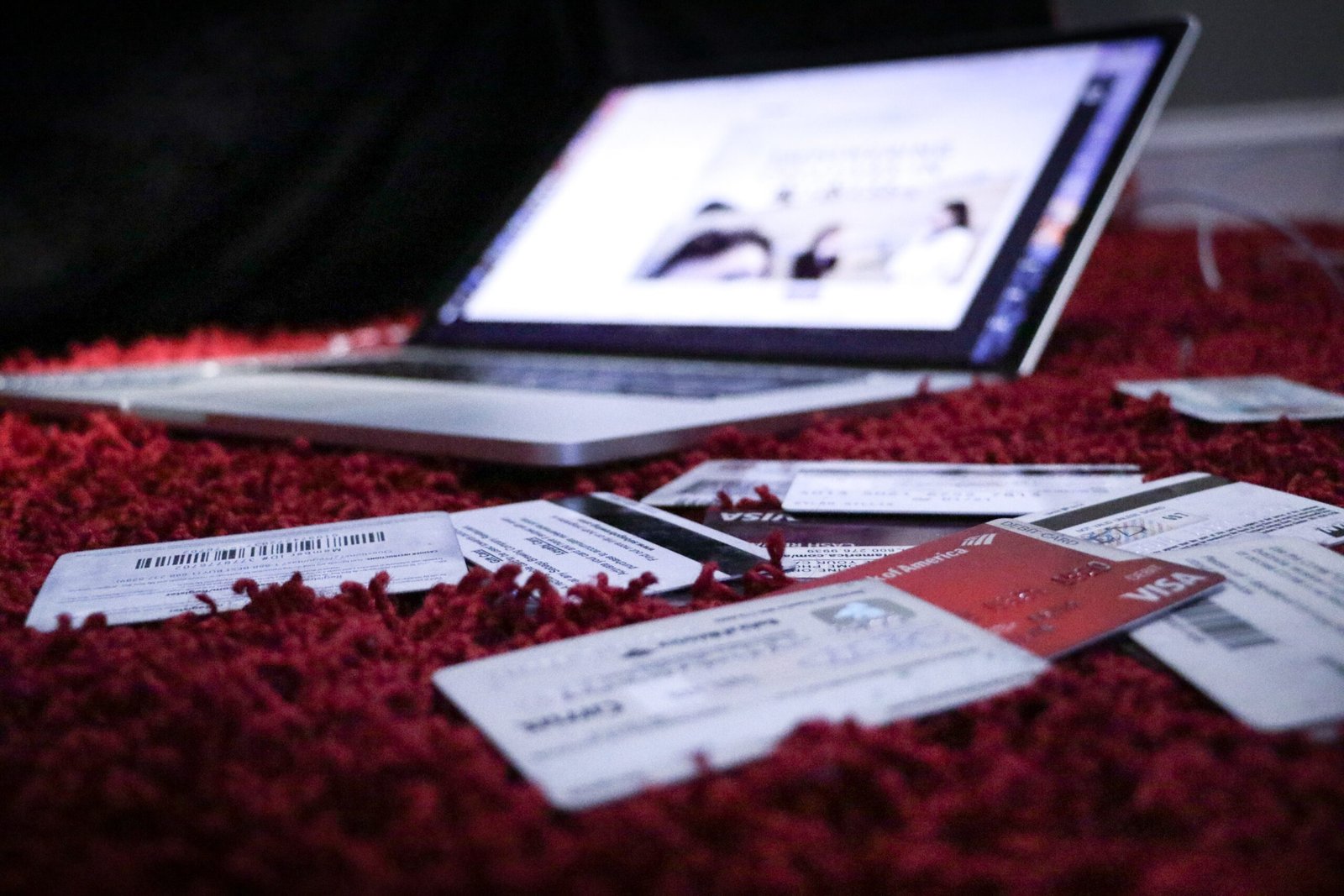

Avoiding and Escaping Payday Loans: Top Strategies to Escape Debt and Avoid Traps

Introduction:

Are you trapped in a cycle of payday loans, struggling to break free from the burden of high-interest debt? You’re not alone. Payday loans can seem like a quick fix for financial emergencies, but they often lead to long-term financial hardship. In this blog post, we will explore the dangers of payday loans, provide alternatives to help you avoid them, and offer strategies to escape the debt trap.

1. Understand the Payday Loan Trap:

Before we dive into alternatives and strategies, it’s crucial to understand the payday loan trap. Payday loans are short-term, high-interest loans typically due on your next payday. They may seem like a convenient solution, but the exorbitant interest rates and fees can quickly spiral out of control, trapping borrowers in a cycle of debt.

2. Explore Payday Loan Alternatives:

To avoid falling into the payday loan trap, consider these alternatives:

- Emergency Savings: Build an emergency fund to cover unexpected expenses.

- Personal Loans: Seek out low-interest personal loans from reputable lenders.

- Credit Union Loans: Join a credit union and explore their loan options.

- Installment Loans: Look for installment loans with reasonable interest rates and repayment terms.

3. Responsible Borrowing Strategies:

When borrowing money, it’s essential to adopt responsible strategies:

- Budgeting: Create a realistic budget to manage your finances effectively.

- Research: Thoroughly research lenders and loan terms before committing.

- Loan Comparison: Compare interest rates, fees, and repayment terms to find the best option.

- Read the Fine Print: Carefully review loan agreements to understand all terms and conditions.

4. Seek Financial Counseling:

If you’re struggling with payday loan debt, consider seeking professional financial counseling. Non-profit organizations and credit counseling agencies can provide guidance, negotiate with lenders, and help you develop a plan to repay your debts.

5. Payday Loan Debt Relief Options:

If you’re overwhelmed by payday loan debt, several options can provide relief:

- Debt Consolidation: Combine multiple debts into a single, more manageable loan.

- Debt Settlement: Negotiate with lenders to reduce the total amount owed.

- Bankruptcy: As a last resort, consult with a bankruptcy attorney to explore this option.

FAQs:

Q: How do payday loans work?

A: Payday loans are short-term loans that typically require repayment on your next payday. They often come with high interest rates and fees, making them a costly borrowing option.

Q: Can payday loans affect my credit score?

A: Payday loans generally do not appear on your credit report, but if you default on the loan, the lender may report it to credit bureaus, negatively impacting your credit score.

Q: Are there any alternatives to payday loans for emergency cash?

A: Yes, alternatives include building an emergency savings fund, seeking low-interest personal loans, or exploring credit union loans.

Tips:

- Tip 1: Prioritize building an emergency savings fund to avoid relying on payday loans.

- Tip 2: Be cautious of predatory lenders and read loan agreements carefully.

- Tip 3: Consider seeking financial counseling if you’re struggling with payday loan debt.

Conclusion:

Escaping payday loan debt requires a combination of responsible borrowing strategies, exploring alternatives, and seeking professional help when needed. By understanding the dangers of payday loans and implementing these strategies, you can break free from the cycle of debt and regain control of your financial future.

Call to Action:

Share this blog post with others to spread awareness about the dangers of payday loans and help them escape the debt trap. Together, we can empower individuals to make informed financial decisions and build a more secure future.