Top 10 Strategies for Negotiating Lower Bills and Interest Rates

Introduction:

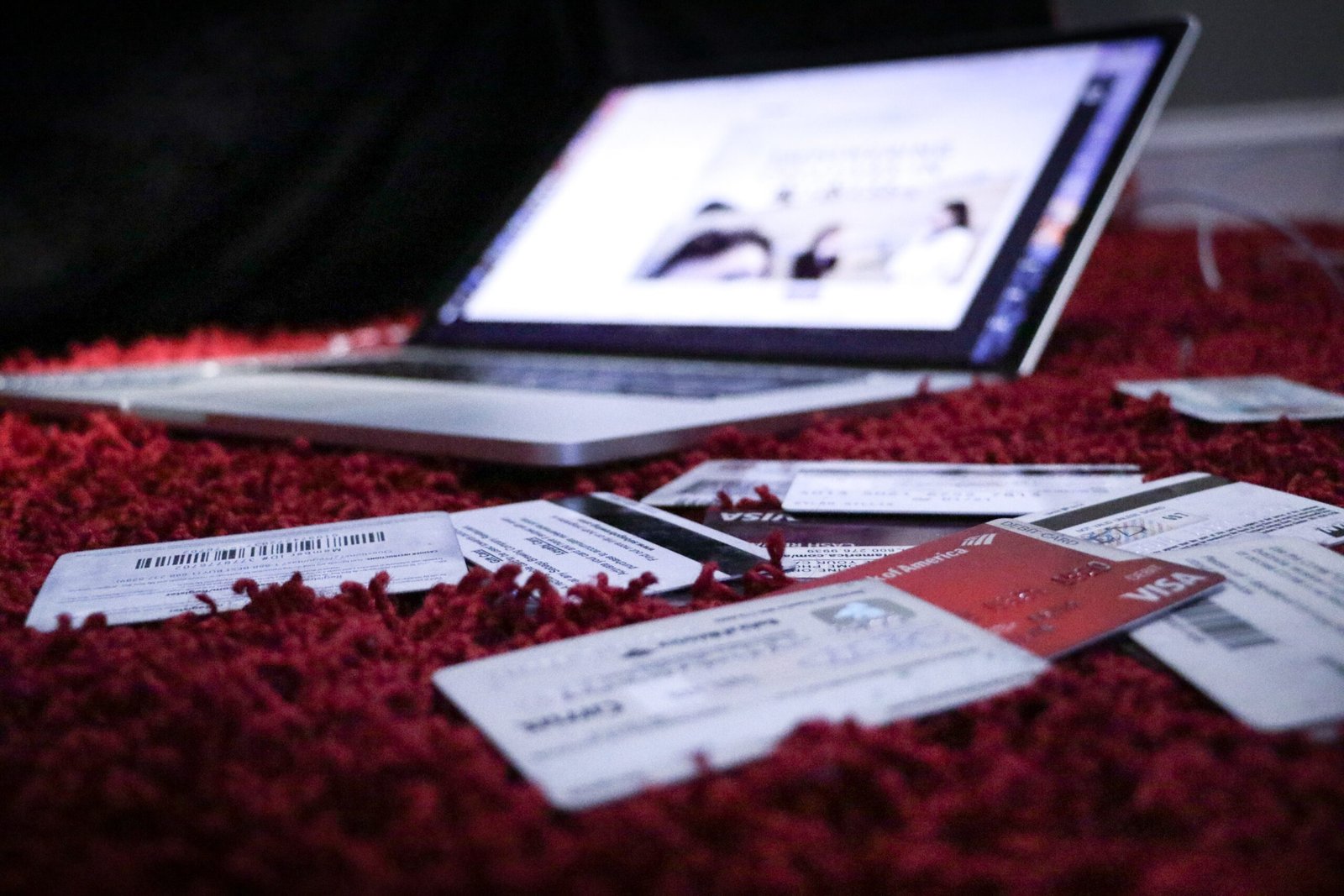

Are you tired of paying high bills and interest rates that eat away at your hard-earned money? Negotiating lower bills and interest rates is a smart way to reduce your monthly expenses and keep more money in your pocket. In this blog post, we will discuss the top 10 strategies for negotiating better rates on your bills and lowering your interest rates. Whether it’s credit card bills, utility bills, or loan interest rates, these negotiation techniques will empower you to take control of your finances and save money.

1. Do Your Research:

Before you start negotiating, it’s essential to gather information about current trends and rates. Stay updated with the latest news and market conditions related to your bills and loans. This knowledge will give you an edge during negotiations and help you make informed decisions.

2. Assess Your Current Expenses:

Take a close look at your monthly expenses and identify areas where you can reduce costs. This could include cutting back on unnecessary subscriptions, renegotiating insurance premiums, or finding more affordable alternatives for services you use regularly.

3. Contact Service Providers:

Reach out to your service providers, such as credit card companies, utility companies, and lenders, to discuss your desire for lower rates. Explain your situation, highlight your loyalty as a customer, and inquire about any available promotions or discounts. Many companies are willing to work with customers to retain their business.

4. Highlight Your Payment History:

If you have a good track record of making timely payments, make sure to mention this during negotiations. Your positive payment history can be used as leverage to negotiate lower interest rates or better terms.

5. Consider Balance Transfer Offers:

If you have credit card debt with high interest rates, explore balance transfer offers from other credit card companies. Transferring your balance to a card with a lower interest rate can save you money in the long run. However, be sure to read the terms and conditions carefully and watch out for any balance transfer fees.

6. Negotiate with Confidence:

Approach negotiations with confidence and a clear understanding of your financial goals. Be persistent, but also be polite and respectful. Show the service provider that you are serious about finding a mutually beneficial solution.

7. Seek Professional Help:

If negotiating on your own seems overwhelming, consider seeking assistance from a professional debt negotiator or financial advisor. These experts can provide guidance and negotiate on your behalf, potentially securing better rates and terms for you.

8. Consolidate Your Debts:

If you have multiple debts with high interest rates, consolidating them into a single loan or credit card with a lower interest rate can simplify your finances and save you money. This strategy can also help you pay off your debts faster.

9. Be Prepared to Walk Away:

If negotiations are not yielding the desired results, be prepared to explore other options. Sometimes, switching service providers or refinancing loans with a different institution can lead to better rates and terms.

10. Track Your Progress:

Once you’ve successfully negotiated lower bills and interest rates, track your progress and ensure that the agreed-upon changes are implemented. Stay vigilant and review your bills and statements regularly to make sure you are receiving the promised benefits.

FAQs:

Q: How long does the negotiation process typically take?

A: The negotiation process can vary depending on the service provider and your specific situation. It could range from a few minutes to several weeks. Patience and persistence are key.

Q: Is it possible to negotiate interest rates on student loans?

A: Yes, it is possible to negotiate interest rates on student loans. Contact your loan servicer and inquire about any available options for rate reduction or refinancing.

Q: Can negotiating lower bills affect my credit score?

A: Negotiating lower bills should not directly impact your credit score. However, if you miss payments or default on your obligations, it can have a negative effect. It’s important to continue making timely payments during the negotiation process.

Tips:

- Always be polite and respectful during negotiations.

- Keep detailed records of your conversations and agreements.

- Consider using online negotiation platforms that can help streamline the process.

- Stay proactive and regularly review your bills and interest rates to identify potential negotiation opportunities.

- Share your success stories and tips with others to encourage them to negotiate better rates and lower their bills.

Conclusion:

Negotiating lower bills and interest rates is a powerful way to take control of your finances and save money. By following these top 10 strategies, doing your research, and being confident during negotiations, you can successfully reduce your monthly expenses and improve your financial well-being. Remember, persistence and patience are key when it comes to negotiating better rates and terms. Start today and start saving!

Call to Action:

Share this blog post with your friends and family to help them negotiate lower bills and interest rates. Together, we can empower more people to take control of their finances and achieve financial freedom.